Politics and Poker: Fed Rules, Schmules

Editors' note: New contributing columnist Denis Campbell brings an independent and experienced eye to poker's political scene. Campbell has worked closely in the past with former Cabinet Secretaries in the Carter and Clinton administrations, Ambassadors and members of Congress. He offers commentary on US and UK politics for the BBC and Huffington Post. Here, Denis offers his insights on matters affecting poker. Denis' views do not necessarily reflect those of PokerNews.

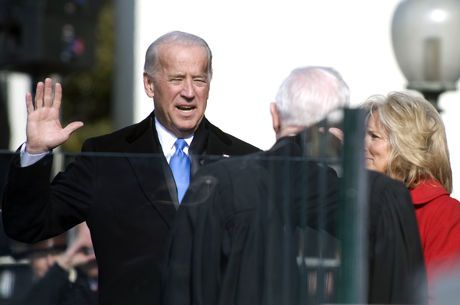

Yes, the Fed has published final rules set to go into effect the day before President Barack Obama takes office. Yes, he is a noted poker player. Yes, were this any other time in history, he would likely rule favorably and move to repeal UIGEA (the Unlawful Intertnet Gambling Enforcement Act). And while "Yes we can" was his famous campaign mantra, it's time for a reality check.

Otherwise, you risk, as a Delta Airlines representative said politely but firmly to a whining, disgruntled business traveler within earshot one day, "Sir, right now there are only two people on this planet who care where your luggage is and one of us is rapidly losing interest!"

At the end of the day, repealing UIGEA is priority number 1,342 on a growing list of crises the incoming president and Democratic administration will face in 64 days' time. While this decision will be driven by Rep. Barney Frank (D-MA), Sen. Ron Paul (R-TX), Democratic Speaker Nancy Pelosi and Republican Sen. John McCain, intense lobbying by the industry could show a high level of economic insensitivity. A lack of restraint right now could backfire badly. A line such as, "Gee, I'm sorry you've lost your house and your job but GambleHereNOW.net will gladly double your initial deposit through the end of the year," might not hit the right sensory acuity notes even on Capitol Hill, a place known for being out of tune and out of step.

In articles this morning it is clear the incoming President faces crises on multiple fronts. Two wars, economic meltdown, banks and an automotive industry on life support, massive job losses, zero consumer confidence, retailers bracing for their worst year ever and one can perhaps see why it's hard to find credible support for repealing UIGEA without staff laughing themselves silly on the other end of the phone.

Barney Frank is a shrewd man. His office knows UIGEA was a stupid 11th-hour inclusion in the Safe Ports Act. No one even read it. No one reads final bills on the Hill (not even the Patriot Act), especially those rushed close to adjournment. And even if they had, it was not a "white hot"-enough button to vote against the rest of the bill. Frank and Ron Paul tried to repeal it last year without success. Now Frank has a bill sitting in committee waiting for the new Congress that will at least give Internet gaming its day in court.

And let's have a bit of cold-water reality here. It's only been two weeks since the election and President-elect Obama still has two months before taking control. In the interim he must fill thousands of positions and get ready to govern.

So take a deep cleansing breath, step back from the keyboard (and the hyperbole) and let's review what might happen?

Members of the transition team either laugh out loud or question my sanity, usually with the not-for-attribution quote, "We're in the midst of an economic meltdown and you're checking the pulse for a gambling bill?!?!" (The punctuation is my addition.)

Here's what we're dealing with and what's likely to happen, since I do keep an ear to the ground and the only state electoral vote I missed 12 days ago was Missouri, where votes are still being counted with a narrow 5,000-vote majority for McCain and only NBC has declared it. You might want to listen…

My "Fairy Godmother" Scenario

1. An omnibus bill on or about January 24 or 25, 2009 will sail through both houses of Congress. It will contain language invoking the CRA Act of 1996 and overturn dozens of rules, executive orders and signing statements from the outgoing administration that changed the intent of laws passed by Congress. The priorities, though, will be banking, deregulation and the environment. There is a less than 50% chance the final UIGEA federal rules will be included because it is not on that white-hot list.

2. If that language is included, and since Barney Frank has had his own bill eliminating UIGEA sitting in committee for fear of a Senate filibuster, that will emerge from beneath the radar and online poker players could be back in business by the mid-summer.

Rationale: The CRA Act has teeth and the Dems will use it. Many are still smarting from when then-new Vice President Dick Cheney played this game on January 20th, 2001. As Barton Gelman wrote in Angler, The Shadow Presidency of Dick Cheney, "One of his first assignments to his staff was a fast-track review of Bill Clinton's departing orders. That would have been a routine step sooner or later but Cheney had the savvy to call a halt to operations at the Government Printing Office. Not many aides would have thought of it but Cheney knew regulations have no force unless they are published in The Federal Register. Some of Clinton's orders signed during his final hours as President, never made it. The same went for end of term appointments to government jobs. At Cheney's urging, Bush ordered a hiring freeze that covered everyone whose paperwork was incomplete."

The Democrats want payback and yet will move carefully and prudently. Look for Fed Reserve rules to be an 11th-hour addition if they make it at all.

More Likely Scenario: Half a Loaf

The second version of Frank's bill comes out of committee, passes and a conference group of Fed Governors slowly and carefully re-jigger the existing rules during late 2009 on into 2010 to create an online gaming and taxing authority.

The courts will play a role in deciding the future of poker with their previously issued skill-vs.-gambling rulings winning out, and it is a long, slow process. In the end we will have a regulated and US-taxed online gaming world where myriad international holding companies are then forced to become more transparent and operate US-based, taxed and regulated subsidiaries in order to play.

Many are worried about US protectionism. This market will be too good for any of them to pass up. Like that Delta business passenger, they will whine and grumble, but will know when to shut up because that will remain the price to play or fly today.

Denis Campbell is a contributor on politics and business to the BBC, Huffington Post and several UK and US based magazines, newspapers and e-magazines. He publishes the daily e-magazine Vadimus Post (vadimuspost.com). He lives with his wife and kids, writing from a 200-year-old, historic 600-acre sheep farm overlooking the Glamorgan Heritage Coast in South Wales.